UNINTERRUPTED BANKING

No Paperwork, No Delays

Manage your business finances systematically with a fully digital current account. Enjoy instant transactions, automated workflows, and effortless fund management.

UNINTERRUPTED BANKING

Manage your business finances systematically with a fully digital current account. Enjoy instant transactions, automated workflows, and effortless fund management.

01

Process high-volume transactions instantly with fast settlements and zero delays.

02

Automate payroll, vendor payments, and invoices to reduce manual effort and save time.

03

Ensure every payment is encrypted, fraud-proof, and backed by advanced security measures.

04

Gain valuable financial data with detailed reports and analytics for better decision-making.

05

Connect with accounting software and business tools for smooth financial operations.

ACCOUNT HOLDERS

Open a current account with minimal paperwork and instant setup for efficient transactions. Manage vendor payments, payroll, and business finances effortlessly using automated tools.

Get a secure business account to manage client payments efficiently without hidden charges. Enjoy quick fund transfers, easy invoicing, and smooth financial operations anytime.

Scale your venture with a current account designed for business growth and automation. Integrate payment gateways, manage cash flow, and streamline transactions effortlessly.

Process high-volume transactions, payroll, and vendor payouts with advanced banking. Automate approvals, optimize cash management, and ensure smooth operations.

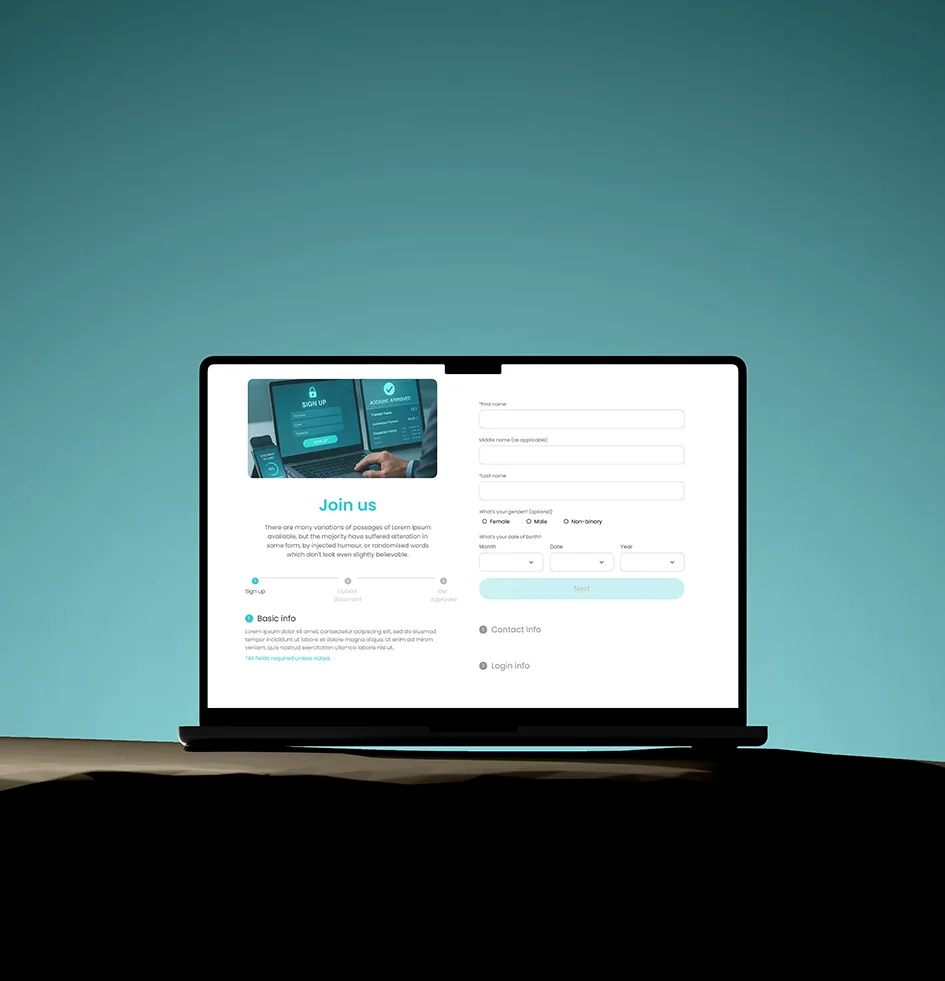

Begin by providing basic business details through a quick and secure online form. Verify your identity and business information within minutes for instant processing.

Submit required business documents digitally without any paperwork or delays. Our secure system ensures fast verification, keeping the process smooth and hassle-free.

Once documents are verified, your current account gets activated quickly. Receive instant confirmation and access powerful banking tools for simplified financial management.

Enjoy effortless fund transfers, automated payouts, and secure transactions. Integrate with business tools and payment gateways to manage all finances efficiently.

BANKING EXPLAINED

Discover the key differences between a digital current account and traditional banking. Enjoy faster transactions, automation, and crystal-clear financial management with zero hassle.

Digital current accounts offer quick payment processing with optimal transfers. Traditional banks may involve additional steps, depending on banking policies and processing times.

Manage finances online through an easy-to-use dashboard and mobile app. Traditional banking provides both in-person and online services, catering to different preferences.

Digital current accounts support automated payments and integrations with business tools. Traditional banks often provide structured services with manual processing options.